By: Rick Kessler | September 9, 2019

While declining wholesale shipments have apparently triggered a firestorm from Wall Street analysts, RV Industry Association (RVIA) officials are quick to point out that the past couple of years, when filtered through a historical context, represent some of the industry’s best on record.

The bottom line: The sky is hardly falling. In fact, data supports the notion that dealers have successfully been selling excess inventory and the industry is about to see the line graph intersection of retail demand vs. production rates.

Scott Stropkai, president of Grand Rapids, Mich.-based Statistical Surveys Inc. (SSI), the RV industry’s leading provider of market data, offered, “While wholesale shipments are a good barometer, the real health of the RV industry is determined by retail sales. If consumers are still buying units at historical high levels, which they are, then wholesale shipments will follow.

Furthermore, while retail sales are down 9.14% through July of this year officials said 2019 still presents a robust market as Stropkai noted, “So far, 2019 is the third best year in recorded history for retail sales of RVs,” adding that, “2018 was the best year ever, so are comparisons this year are versus the strongest market in history so we need to put that in context when looking at this year’s numbers.”

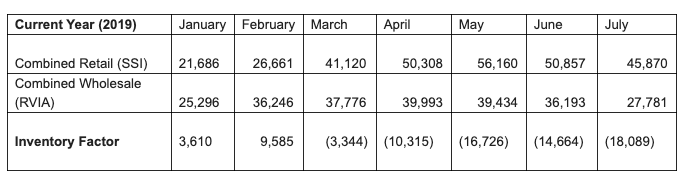

According to SSI’s latest report, retail has outpaced wholesale by 49,943 units YTD through July, indicating inventories are declining. As a comparison, last year through July retail outpaced wholesale by 16,427.

“August and September are typically months where retail outpaces wholesale while the last quarter of the year are inventory build months as dealers prepare for the following year,” Stropkai related.

As far as wholesale shipments, the industry is expected to total 401,200 units in 2019, off 17.1% from 2018, according to independent RV industry analyst Richard Curtin, director of Surveys of Consumers at the University of Michigan. However, the rate of decline will ease substantially in 2020 with RV shipments projected to be down 3.5% at 387,400 units.

This forecast comes after the industry topped 504,000 wholesale shipments in 2017, the culmination of an unprecedented period of growth following the 165,000 units in 2009 during the Great Recession.

“So are we at 504,600 units right now? No — but that is an all-time record high. But just because you’re seeing a little bit of a retreat on that all-time high over the last couple of years, that doesn’t mean we’re on our way to 160,000,” said RVIA Senior Director of Research Bill Baker.

Baker pointed out that even if 2019 finishes with the predicted 401,200 wholesale shipments, it’s still the fourth best year on record. Likewise, the projected 387,000 units in 2020 would represent the sixth best year on record. And both figures, he added, would dwarf the 30-year average of 294,700 units, the 20-year average of 331,200 units, and the 10-year average of 332,200 units.

Baker pointed out that even if 2019 finishes with the predicted 401,200 wholesale shipments, it’s still the fourth best year on record. Likewise, the projected 387,000 units in 2020 would represent the sixth best year on record. And both figures, he added, would dwarf the 30-year average of 294,700 units, the 20-year average of 331,200 units, and the 10-year average of 332,200 units.

“So, is the market falling from an all-time high? Yes, it is. But, put in context, it’s still good a market in any comparable record when historically looking at wholesale shipments,” Baker told RVBUSINESS.com.

“As you look at the life cycle of the industry over the last 30 years,” he continued, “it’s just one of those periods where you’re going to see shipments received from a high, find a new level for a few years and then start heading back up. ‘An expected cyclical reset’ would be a good way to term it, and that’s sort of the big picture of where the market stands now.”

He added that while there is a bit of turbulence — tariffs and domestic political uncertainty being two of them — all economic indicators remain favorable.

“In the grand scheme of things, the overall economy is still healthy. It’s still expanding. It’s still growing. Consumer spending is really strong right now and inflation rates is not an issue — and it’s anticipated the Fed will continue to keep an eye on that to keep the economy on a growth path,” Baker said.

“And then if you look in the long-term picture,” he continued, “you’ve got Millennials that have shown they have a great interest in RV travel and camping. They’re the biggest segment of the workforce now and they’re just now entering their ‘family-building, RV-buying’ type of years. The Boomers still have a tremendous impact on the market, and Generation X — which is a pretty big demographic — are buying RVs, too.

“You have three generations buying RVs now, so from a long-term perspective — and with all that RVIA and RVDA does to help promote the market and promote ownership through Go RVing — we still have a very bullish outlook for the next decade and beyond.”

Source: https://rvbusiness.com/rv-industry-forging-ahead-despite-some-headwinds/